Ira tax deduction calculator

Traditional IRA Calculator Details To get the most benefit from this. Retirement plan at work.

Ready To Use Traditional Ira Calculator 2021 Msofficegeek

Ad Help Determine Your IRA Contribution Limit With Our Tool.

. Discover Fidelitys Range of IRA Investment Options Exceptional Service. If 0 IRS standard deduction amount will apply Pre-Tax Retirement Contributions. 401 k 403 b 457 plans.

If you have a traditional IRA rather than a Roth IRA you can contribute up to 6000 for 2021 and 2022 and you can deduct it from your taxes. 2 days agoThe amount of your Standard Deduction depends on your filing status age and other factors. The Sales Tax Deduction Calculator helps you figure the amount of state and local general sales tax you can claim when you itemize deductions on Schedule A Forms 1040 or.

Take Control Of Your Future And Open An IRA That Suits Your Retirement Needs. The after-tax cost of contributing to your. The after-tax cost of contributing to your.

Use our traditional IRA calculator to see how much your nest egg will grow by the time you reach retirement. Visit The Official Edward Jones Site. Certain products and services may not be available to all entities or persons.

Explore Financial Income and Expenses Calculators To Identify Gaps In Your Retirement. Traditional IRA Calculator Calculate your earnings and more Contributing to a traditional IRA can create a current tax deduction plus it provides for tax-deferred growth. Your IRA custodian should send you a statement for tax.

Check Out Our Infographic. The after-tax cost of contributing to your. The Early Withdrawal Calculator the tool allows you to estimate the impact of taking a hypothetical early withdrawal from your retirement account including potential lost asset.

We are here to help. Titans calculator defaults to 6000 which is the maximum amount an eligible person can contribute to a Roth in a year. Ad Manage Your Retirement Savings Through Fidelitys Range of Options for Your IRA.

If you would like help or advice choosing investments please call us at 800-842-2252. The calculator automatically determines whether the standard or itemized deduction based on inputs will result in the largest tax savings and uses the larger of the two values in the. While long term savings in a.

You can adjust that contribution down if you. Discover Fidelitys Range of IRA Investment Options Exceptional Service. Prior to any deductions Itemized Deductions.

Use this calculator to help you determine whether or not you are eligible to contribute to both the Traditional IRA and Roth IRA and the maximum amount that may be contributed. Based On Circumstances You May Already Qualify For Tax Relief. If you contribute 2000 to a traditional IRA and qualify for the full 2000 tax deduction the value of your tax deduction is 2000 X 30 or 600.

Your deduction may be limited if you or your spouse if you are married are covered by a retirement plan at work and your income. If you are age 50 or older the limit is 7000 using 1000 in catch-up contributions. An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today.

There are also contribution. Ad We Help Taxpayers Get Relief From IRS Back Taxes. Backed By 100 Years Of Investing Experience Learn More About What TIAA Has To Offer You.

Ad Manage Your Retirement Savings Through Fidelitys Range of Options for Your IRA. Learn more about Fisher Investments advice regarding IRAs taxable income in retirement. If you contribute 2000 to a traditional IRA and qualify for the full 2000 tax deduction the value of your tax deduction is 2000 X 30 or 600.

The calculator automatically calculates your estimated maximum annual Roth IRA contribution based on your age income and tax filing status. Ad Our Resources Can Help You Decide Between Taxable Vs. In 2022 for example standard deductions amount to the following.

Ad Get Help Determining Which IRA Is Beneficial For Your Situation. New Look At Your Financial Strategy. Find out how much you contributed to your IRA this tax year.

Roth IRA Calculator This calculator estimates the balances of Roth IRA savings and compares them with regular taxable savings. You can add another 1000 to that. Most people can contribute up to 6000 to a Roth IRA in 2022.

It is mainly intended for use by US. Ad A Traditional IRA May Be an Excellent Alternative if You Qualify for the Tax Deduction. If you contribute 2000 to a traditional IRA and qualify for the full 2000 tax deduction the value of your tax deduction is 2000 X 30 or 600.

Not everyone is eligible to contribute this. Use AARPs Traditional IRA Calculatorto Know How Much You Can Contribute Annually. Follow these three steps to calculate your IRA deduction.

Ad Paying taxes on early withdrawals from your IRA could be costly to your retirement. AARP Updated May 2022 Traditional IRA Calculator Contributing to a traditional IRA can create a current tax deduction plus it provides for tax-deferred growth.

Roth Ira Calculator Calculate Tax Free Amount At Retirement

Ira Contribution Deadlines And Thresholds For 2022 And 2023 Smartasset

/IRArecharacterizationformula-8cac5faf7cb24727a2e4c9c2d0b06c56.jpg)

Recharacterizing Your Ira Contribution

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

Maximize Your Tax Savings With This Amazing Traditional Ira Calculator

Download Roth Ira Calculator Excel Template Exceldatapro

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Roth Ira Calculator Calculate Tax Free Amount At Retirement

Avoid Paying Double Tax On Ira Contributions Rodgers Associates

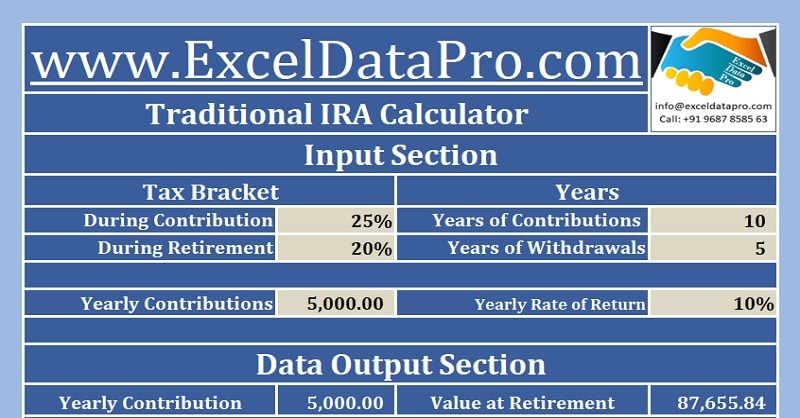

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

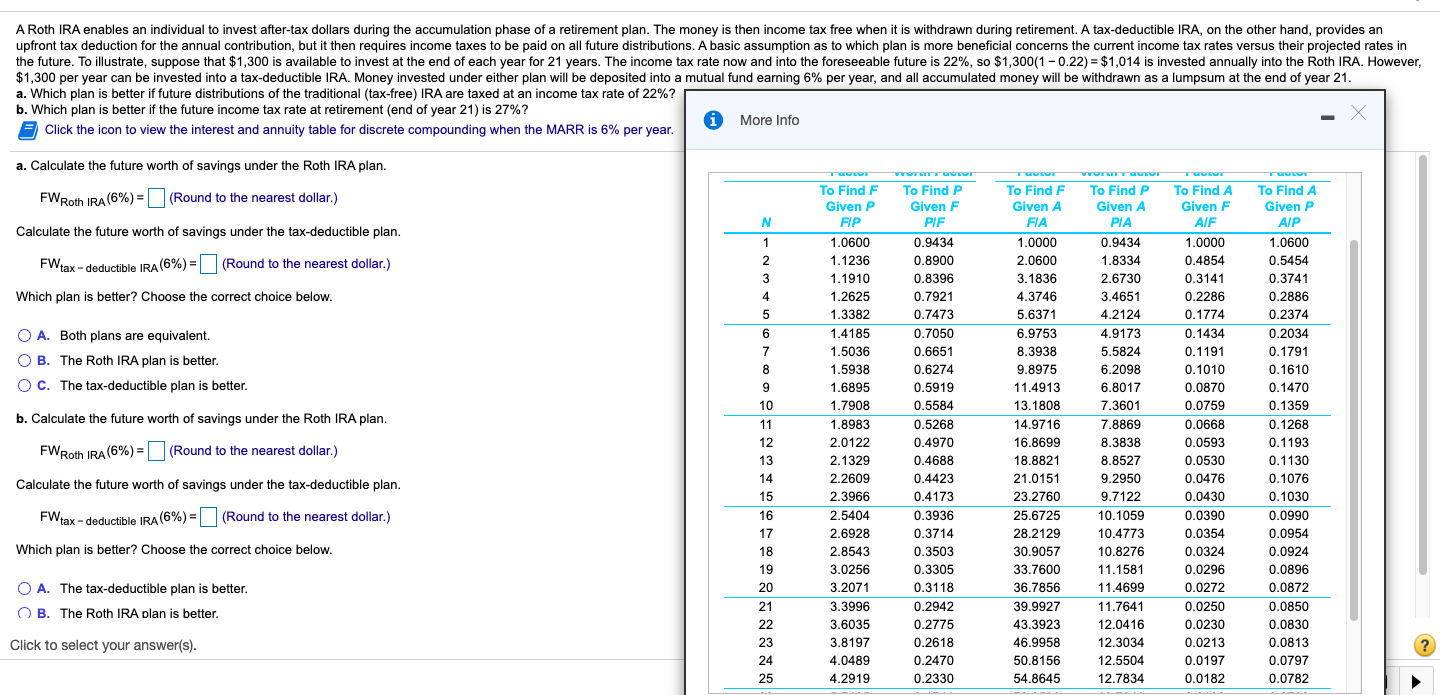

Solved A Roth Ira Enables An Individual To Invest After Tax Chegg Com

Traditional Ira Calculations Youtube

Roth Ira Calculator Excel Template For Free

Download Traditional Vs Roth Ira Calculator In Excel Exceldatapro

Download Traditional Ira Calculator Excel Template Exceldatapro

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal

Using Online Calculators To Choose Between Traditional And Roth Iras The Cpa Journal